Living in Bali tax free: is it (really) possible?

Bali and the rest of Indonesia attract a lot of digital nomads, entrepreneurs and people staying in the country for longer terms. To an outsider, it may even seem that Bali could be some sort of tax-haven. But is it?

Here is what you should know if you are interested in living in Bali without paying taxes.

Can you live in Bali tax-free?

Living tax-free is sometimes seen as the holy grail, especially for people coming from countries where tax rates are sometimes seen as punitive.

Technically, yes living in Bali tax-free 100% legally is possible.

However, not everyone can afford to do so. For the majority of people who are actually living in Bali or anywhere else in Indonesia, they will have to pay taxes at some point.

And do not listen too much to foreigners telling you that they spent years in Bali without paying any taxes. They are more often than not in absolutely illegal situations and could face serious problems the day the tax department (called the Pajak) looks into their case.

Let’s have a look at what makes you a tax-resident in Indonesia, and the few situations where you might get away tax-free without running into problems.

What kind of taxation system is used in Indonesia?

The taxation system in Indonesia is actually similar to the ones used in many countries in the world.

Indonesia tax its residents on their worldwide income

If you are a tax resident in Indonesia, you will have to declare your worldwide income. This includes your income generated in Indonesia, but also your income coming from other countries, whether it’s been brought back into Indonesia or not.

In most cases, treaties exist between countries to avoid double taxation.

Indonesia is therefore NOT a country with a territorial tax system that would make offshore income tax-free automatically for all its citizens and residents (more on that later).

Most taxes are withheld and collected by companies

Most Indonesian citizens and residents do not have to deal much with the tax department. The tax collection is mostly done by companies:

- Through the VAT for sales and purchases

- Thanks to the withholding tax for all employees (local and foreigners)

If you are employed by a company like many Indonesian citizens and that this is your only income, your company will be the one paying all of your income tax, so that you don’t have to do it yourself.

Individual citizens and resident report their income to the authorities yearly

An individual taxpayer in Indonesia only has to report once a year his/her income to the tax department.

If all the income received has been collected by the company employing him/her, then the tax return is complete. If some other income has to be declared and collected, then additional tax payment to the tax department might be needed.

Main taxes that could affect foreigners in Indonesia

The main taxes affected foreigners living in Indonesia are the following:

- The VAT (10%) on all your purchases

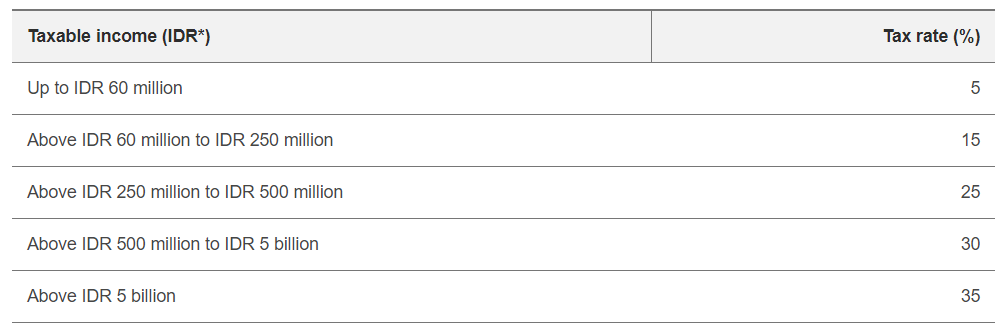

- The income tax (see below the progressive rate)

- Taxes on severance payments (progressive rate)

- Taxes on pension payments

What makes you a tax-resident in Indonesia?

First, it’s important to know what automatically makes you a tax resident in Indonesia.

Reminder: being a tax-resident doesn’t always mean that you have to pay taxes in Indonesia. It means however that you need to declare your income to the authorities.

Working with / for Indonesian companies automatically makes you a tax resident in Indonesia

If you earn money while in Indonesia from an Indonesian source, whether it’s by being employed by an Indonesian company or having an Indonesian company as a client, you are automatically liable for taxes in Indonesia.

Simply put, there is no way to be legally tax-free if you are employed in Indonesia or are working with Indonesian clients while staying in Indonesia.

Nb: A working KITAS / KITAP and the associated work permit are also mandatory to work for an Indonesian company or with an Indonesian client.

Having a residence permit in Indonesia (KITAS/KITAP) does make you a tax resident

Residency in Indonesia makes you liable for taxes in Indonesia.

This is true for working visas, but also for other KITAS / KITAP, even if they do not involve generating income on Indonesian soil and are not associated with work permits.

So even if you are on a spouse KITAS or on a KITAS that doesn’t allow you to work at all such as an investor KITAS or a Retirement KITAS, you will still have to report your income to the tax department since you are expected to live most of the year in the country.

Note: in some cases, you might not have to pay any taxes thanks to double taxation treaties or lack of income. But you’ll still have to report it.

Spending more than 180 days in Indonesia means you are liable for taxes in Indonesia

Legally speaking, anybody staying more than 180 days in Indonesia, regardless of its visa status, should report to the tax department in Indonesia. The law is very clear on the matter, but its enforcement is a bit more blurry.

The main issue, at least at the moment, being that some of the foreigners staying more than 180 days in Indonesia aren’t always considered as residents due to their visa status (they have a B211 for instance and not a KITAS). And so far, you need a KITAS to apply for a tax Identification number called NPWP.

So theoretically, a tourist, a visa B211 holder or anyone living in Bali more than 180 days during the year, even without working here, should declare their earnings and potentially pay some taxes in Indonesia, but at the moment they can’t do so if they aren’t on a resident visa.

There is therefore a grey area with the assumption that as long as foreigners earn income in another country (and not from Indonesia), that country is already taxing them and so it is not really an Indonesian issue.

The tolerance often disappears when foreigners violate the purpose of their stay and work illegally in Indonesia with the wrong visa or without the appropriate work permit. They may then become liable for all the unpaid taxes in Indonesia, likely face deportation and even jail-time for the most serious offences.

Living in Bali tax-free: your options to do it legally

So what are your options to live tax-free legally in Indonesia? Actually, there are only two of these. Anything else is likely to be illegal.

Be a tourist and you won’t be liable for taxes in Indonesia (other than VAT)

If you are a tourist in Indonesia, you do not have to report or pay anything to the government.

Qualifying as a tourist is quite easy:

- Do NOT work for an Indonesian company or have one as your clients while in Indonesia

- Do NOT get a residence permit such as a KITAS / KITAP

- Do NOT stay more than 180 days / year in Indonesia

Keep in mind that this makes you free of reporting your taxes in Indonesia. But you’ll still have to pay some taxes, for example the VAT on all your purchases.

Use the 2nd home visa (if you qualify) and enjoy Bali residence tax-free on your offshore income

The 2nd home visa is the only way to live tax-free in Bali or in Indonesia in general.

But this visa and the tax-free living that comes with it imply two things:

- You do NOT work for/with Indonesian companies at all. All your revenue is from an offshore source and is tax-free for Indonesia (the income might be taxed wherever it originates from or not taxed at all)

- You have deposited 2 billions rupiah (135,000$) in a bank account in Indonesia

The ones that qualify for this visa can really and legally enjoy a tax-free Bali, especially if the country of origin doesn’t tax their income either.

Conclusion

To sum up, there aren’t many ways to live really tax-free in Bali as a foreigner.

If you want to avoid paying your taxes to the Indonesian government, your only two options are:

- Stay a tourist (on a VOA or B211 visa). No work in Indonesia, no residence permit and no more than 180 days and you are in the clear.

- Get a 2nd home visa that makes your offshore income tax-free from Indonesia.

The moment you have a residence permit and/or start working for/with Indonesian companies, you become a tax resident in Indonesia and you therefore have the obligation to report your worldwide income to the tax authorities.

Whatsapp us now if you need advice to pick the best visa to optimise your tax situation.